If you’ve modified your vehicle but haven’t updated your insurance, you may lack coverage. As the owner of a custom car or truck, you take pride in your vehicle. Make sure your modifications are protected.

Vehicle and Truck Modifications

Some people are happy with their car exactly as it is when they drive it off the lot, but others improve and personalize their vehicles with aftermarket customizations. There are many vehicle coverage options, ranging from minor and superficial to major and impactful.

- Suspension and ride height adjustments can improve the way your vehicle handles.

- New seats and upholstery can add a sense of luxury to the interior.

- Turbocharging or supercharging the engine can increase power and performance.

- Installed GPS and phone systems can make your ride more convenient.

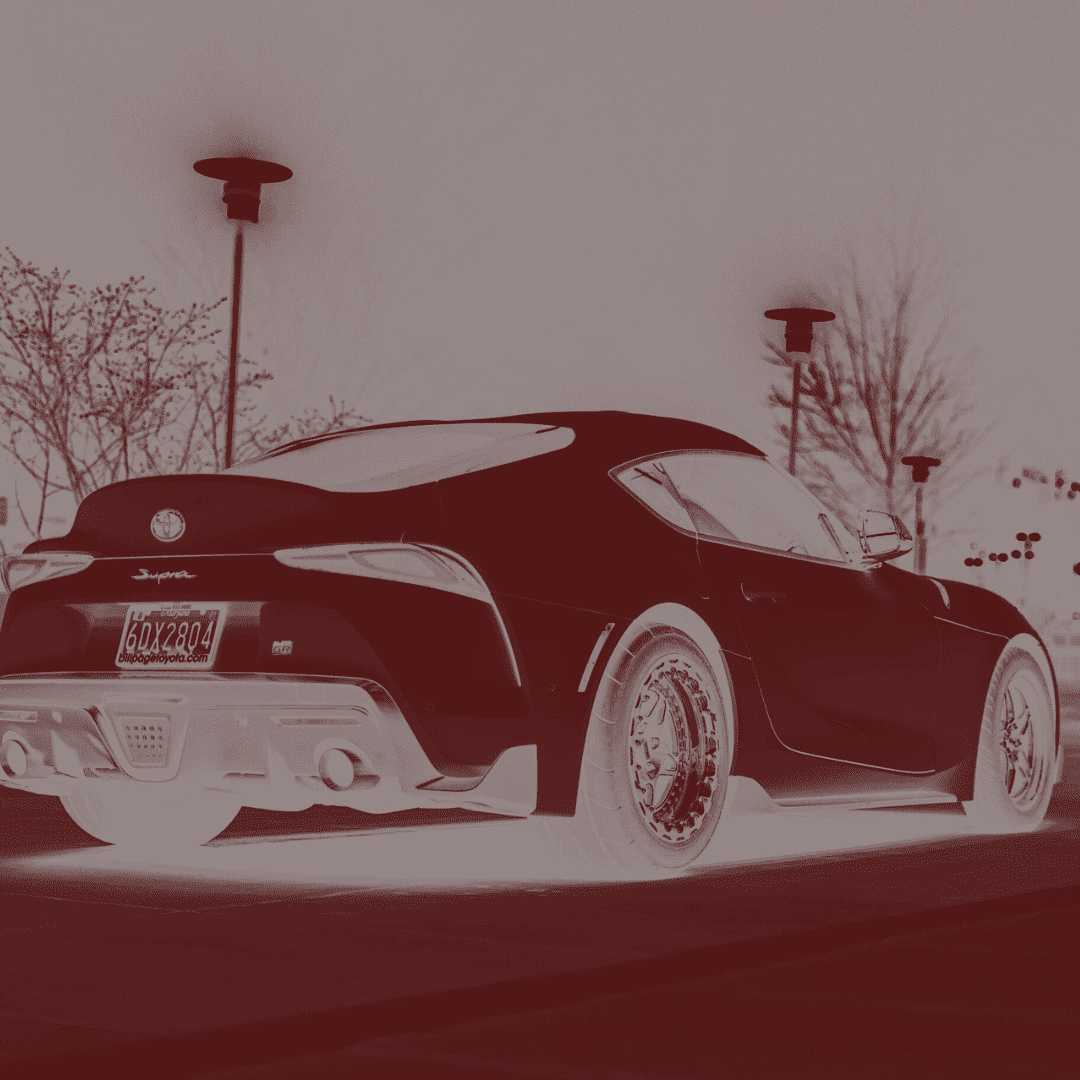

- New tires and rims can give your vehicle the appearance you desire.

Why Insuring Your Vehicle Modifications Is Important

Auto insurance helps car owners comply with state auto insurance requirements as well as with lender requirements. Car insurance also provides protection from vehicle damage and theft. Since a vehicle is a major investment, it makes sense to protect your investment with auto insurance coverage. Otherwise, you’ll have to pay the full cost to repair or replace your vehicle if it is damaged in a crash, animal collision, storm, or fire – or if it’s targeted by car thieves or vandals.

Whether you’re insuring your vehicle to comply with state laws, meet auto lender requirements, or minimize the risk of financial loss, it’s important to consider how vehicle customizations could impact your coverage.

- Some vehicle modifications impact the performance of a vehicle and may increase certain risks. For this reason, some insurance companies will not insure certain modifications. If you fail to disclose vehicle modifications, the insurer could use this as grounds to cancel your insurance policy. The worst time for this to happen is when you have a claim and find out you don’t have coverage.

- Modifications could increase the value of your vehicle and the amount of coverage you need. Let’s say your vehicle is worth $30,000 when you buy it. You modify your vehicle, bringing its value up to $50,000. Then, your vehicle is stolen. Since you have comprehensive (other than collision) coverage, you believe your vehicle is fully covered. When you file a claim, however, you find out your vehicle modifications are not covered.

- Certain customizations could lower your insurance costs. Although many customizations increase the value of a car and therefore increase the cost of insuring it, some customizations could result in lower premiums. For example, if you customize your car with an anti-theft device, you may qualify for a discount with some insurers. To receive this discount, you need to tell your insurer about the modification.

Custom Truck Insurance and Modified Vehicle Coverage Options

If you modify your vehicle, you can secure vehicle modification insurance coverage as an add-on endorsement to your main auto insurance policy or as a separate insurance policy. Vehicle modification or custom truck insurance may be available for modifications to the:

- Appearance of your vehicle, such as paint, decals, or rims.

- Performance of your vehicle, such as suspension and engine modifications.

- Interior of your vehicle, such as the installation of new seats or a GPS system.

Understanding Vehicle Modification Risks

Although many vehicle modifications make vehicles more valuable, some modifications make them dangerous or even illegal. Insurance companies will refuse to insure illegal upgrades. Before you modify your vehicle, research the laws in your state.

A few of the most common issues to consider include:

- Window Tinting – You may want to tint your windows to enhance appearance and privacy, but some states have laws that set limits on how much tinting is allowed. For example, Texas Window Tint Standards set limits for sun screening on the windshield, side windows, and rear window.

- Turbochargers and Superchargers – State law may prohibit aftermarket turbochargers or superchargers or set requirements for the installation of these systems.

- Paint and Decals – Since your vehicle’s appearance is used to identify it, you will need to notify both your car insurer and your state DMV of any changes to your vehicle’s color.

- Vehicle Height – State law may place restrictions on vehicle height adjustment. For example, Texas law states that the maximum height of a vehicle and its load may be is 14 feet. There are also height rules for head lamps, tail lamps, and rear reflectors.

- Nitrous Oxide – Boosting your car’s power with nitrous oxide is illegal in most states.

- Exterior Lighting – Excessively bright lights can be distracting and may even blind other drivers. To keep nighttime roads safe, some states have laws that limit how bright headlights can be and that ban other exterior lights.

- Wheel Size – Bigger isn’t always better. If you install wheels that are the wrong size for your vehicle, your speedometer readings may be incorrect. Wheel size can also impact your vehicle’s suspension.

Selecting the Right Insurance for Vehicle and Truck Modifications

If you have already modified your vehicle, you may need to update your auto insurance. Although you may be tempted to stay quiet about the customizations, this decision could backfire if your vehicle is damaged, and your auto insurance claim is partially or totally denied.

If you are considering modifying your vehicle with aftermarket upgrades, consider these insurance implications before you make an investment:

- If your vehicle is not street legal, you could face expensive fines and tickets, may be required to pay to reverse the modification, and may not be able to insure your vehicle.

- Some modifications could be dangerous for you or other drivers on the road. These modifications may be illegal or uninsurable.

- A modification may mean you need to increase your coverage amount, add an endorsement to your auto policy, or secure an additional insurance policy.

- Depending on the types of upgrades you have, your insurance company may refuse to insure your customized vehicle.

Have questions? An insurance broker can help you navigate these custom vehicle insurance issues. The team at Watkins Insurance Group is here to help.